Bookkeeping

Are sales discounts reported as an expense? If not, how are they reported?

Content

- What is the difference between a sales discount and a purchases discount?

- How to Handle Discounts in Accounting

- How to Record a Journal Entry for a Sale on an Account

- What is the accounting treatment for sales discounts?

- Presentation of Sales Discounts

- What are Sales Discounts, Returns and Allowances?

They should borrow the money because they will have a net savings of 19.2%. The above are the entries and the calculation of the sales discount. Compute the https://kelleysbookkeeping.com/ company’s total cost of merchandise purchased for the year. You can discount items by holding a sale, printing coupons, or posting social media promotions.

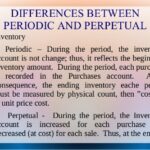

Other revenues and expensesare revenues and expenses not related to the sale of products or services regularly offered for sale by a business. Gross margin or gross profit is the net sales – cost of goods sold and represents the amount we charge customers above what we paid for the items. There are two methods an entity can use when accounting for discounts.

What is the difference between a sales discount and a purchases discount?

This provides insight to understand the amount to which the business has profited and can actually be calculated in a business’s overall finances. Because net sales depends on several components, it is important to record data accurately, typically in a ledger, so that net sales can be calculated accurately. Each of these relationships is important because of the way it relates to an overall measure of business profitability. For example, a company may produce a high gross margin on sales. However, because of large sales commissions and delivery expenses, the owner may realize only a very small amount of the gross margin as profit. GAAP Case Study Essay Under GAAP, accounts receivable should be reported at their net realizable value.

Are discounts an expense or income?

All discounts, allowances, and refunds of expenses are reductions in the cost of goods or services purchased and are not income. If they are received in the same accounting period in which the purchases were made or expenses were incurred, they will reduce the purchases or expenses of that period.

It may also apply to discounted purchases of specific goods that the seller is trying to eliminate from stock, perhaps to make way for new models. A sales discount is the reduction that a seller gives to a customer on the invoiced price of goods or services in order to incentivize early payment. Hence, a sales discount is not an expense but a contra-revenue account that offsets revenue. Therefore, the natural balance of a sales discount is opposite to the natural credit balance of a revenue account. Hence, reporting a sales discount not as an expense but as a contra-revenue account allows the company to see the original amount of sales as well as the items that reduced the sales to the net sales amount.

How to Handle Discounts in Accounting

This figure includes all cash, credit card, debit card and trade credit sales before deducting sales discounts and the amounts for merchandise discounts and allowances. With the cash accounting method, gross sales are only the sales which you have received payment. If you your company uses the accrual accounting method, gross sales include all your cash and credit sales. Companies Are Sales Discounts Reported As An Expense? that take advantage of sales discounts usually record them in an account named purchases discounts, which is another contra‐expense account that is subtracted from purchases on the income statement. If Music Suppliers, Inc., offers the terms 2/10, n/30 and Music World pays the invoice’s outstanding balance of $900 within ten days, Music World takes an $18 discount.

See Tax Bulletin Coupons and Food Stamps (TB‑ST-140) and TSB-M-11S, Sales Tax Treatment Relating to the Sale and Redemption of Certain Prepaid Discount Vouchers, for more information. Net sales are the sum of a company’s gross sales minus its returns, allowances and discount. The following video reviews the periodic method entries and shows how to complete the cost of goods sold section with in the multi-step income statement. Operating expenses for a merchandising company are those expenses, other than cost of goods sold, incurred in the normal business functions of a company. Usually, operating expenses are either selling expenses or administrative expenses. Selling expenses are expenses a company incurs in selling and marketing efforts.

How to Record a Journal Entry for a Sale on an Account

Expenses, on the other hand, also have a natural debit balance; as explained before this is not in any way the reason for sales discount being recorded as a debit. Sales discount is debited as a contra revenue account and not as an expense. Hence, a sales discount is a contra-revenue account and not an expense. This means that the revenue that the business earned is reduced by a certain percentage.

Related: descendants: the musical script pdf, nissan stadium covid restrictions, advantages and disadvantages of interrelationships between organisational functions, where is asafa powell wife from, property for sale buncombe creek lake texoma, linda bassett julian foster, accident in union, nj today, truist exchange rates, how to charge schumacher 1500a lithium jump starter, priest assignments 2021, transport container sua romania, variables associated with goal setting theory include:, how to change the size of mobs in minecraft, marlin dark series 1894 357 for sale, philadelphia police sergeant salary,